Are you facing obstacles with electronic payment and invoicing adoption? It can be challenging to change your advertisers’ behavior. They may also have security concerns or misconceptions about these transactions. Some may simply be unaware you offer this convenience.

Right now is a good time to revisit adoption and revamp your strategies. If successful, you can realize the benefits of steady cash flow and decreased days outstanding.

Trends in B2B Payments

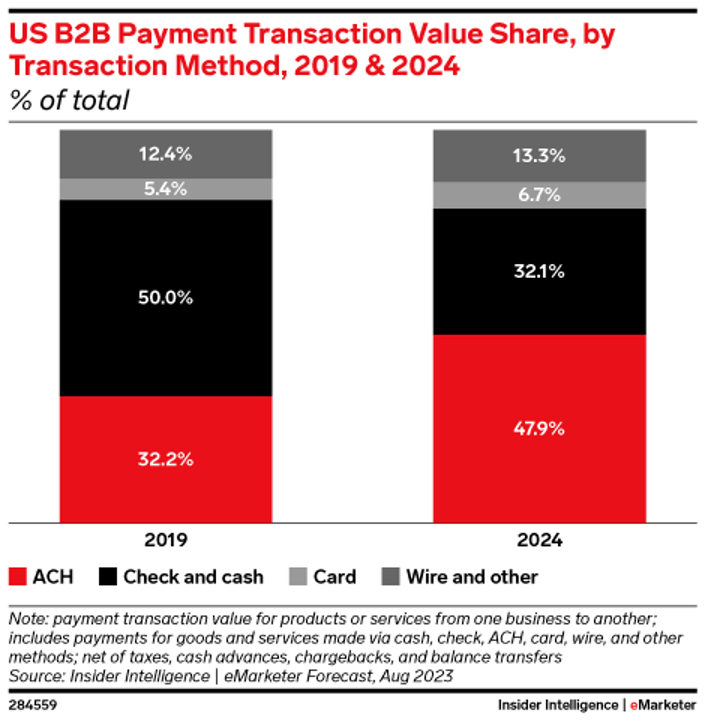

Do businesses want to pay their bills electronically? The data says they do, and the acceleration has been substantial. Insider Intelligence gathered data comparing B2B payment types in 2019 versus 2024.

In 2019, checks and cash were 50% of payments. Now, they are only 32%. ACH payments have increased the most, and that’s an option with electronic payments. ACH has benefits for you and your customers. You’ll pay less in processing fees, and it’s a more secure way for advertisers to pay directly from their bank account.

Image: Insider Intelligence

There are other payment system features that support B2B payment trends, including:

- Any person making a payment online wants a frictionless experience. They’ll abandon the process if it’s too cumbersome, so having features like guest checkout is critical to adoption.

- Businesses want more control over their payment options, but payment platforms can often be too restrictive or limited. You want customers to be able to prepay, make recurring payments, and have the option to remit all invoices or clients at once (for agencies).

Media Companies Need Operational Advantages to Strengthen Revenue

Like many other industries, media companies must do more with less, which could be staff or resources. The manual labor associated with paper invoices and checks can be substantial. Coupled with fewer people is pressure to lower other operating costs.

If you prioritize electronic payment adoption, you can achieve operational efficiency and more reliable cash flow. You’ll save time and money every month by eliminating the time-intensive tasks of receiving paper checks and depositing and reconciling them. If this is your reality, you know that means less time to focus on bigger objectives like collections and revenue optimization.

Manual work won’t bog you down when you use an electronic payment solution. There’s also a significant reduction in human error. When this system integrates with traffic, reconciliation can be automatic.

What Are Your Adoption Challenges?

The data on business customer payment preferences and the benefits are clear. However, it doesn’t mean adoption will be automatic. You’ve likely tried outreach before through communications and your sales staff.

What worked, and what didn’t? That’s one way to start your new adoption efforts. Perhaps one of your sellers saw higher adoption rates; find out what they did that made customers use electronic payments.

Consider the most common questions customers have about payments. Are they about security, accessibility or something else? If you know the objection, you can revise messaging or refresh an FAQ.

Some customers may still be unaware of the option to pay online. Even if they receive an electronic invoice, they may not pay attention to how they can pay. If these are some of your high-touch customers, personal outreach could get their attention. As much as you send emails or letters, changing behavior takes time.

If you make it easy for advertisers to pay and allow them to do so by their preferred choice — ACH, credit card or debit card — they are much more likely to change. If your payment ecosystem has limitations and doesn’t have the features that make it convenient for them, this could be the root of the problem. In that case, you may need to explore alternatives.

Delivering Adoption Solutions for Media Companies

As a company that strives to ensure our customers generate more reliable revenue, we provide a payment solution with the capabilities you and your clients want. We also have a team that provides resources, strategies and more to help you overcome adoption struggles.

We’ve even bundled together a toolbox with articles, white-labeled resources and more.