The 2025 Radio Revenue Outlook

Radio revenue in 2025 has both promise and challenges.

This story has been the refrain for many years, as digital spending increases while airtime has mostly remained flat. In 2024, the industry saw considerable gains thanks to record-breaking political spending. This year ushers in a new normal, where radio competes to win ad dollars at the local level.

The good news is that radio stations are in a perfect position to be the ideal choice for local advertisers. You can deliver integrated campaigns for radio spots and digital ad tactics, creating high-performing, synergistic promotions.

So, how will things shake out in 2025? We turned to our partners and colleagues at BIA Advisory Services to provide the numbers. This, along with our expert insights, should put you on the path to generating more radio revenue in the year ahead.

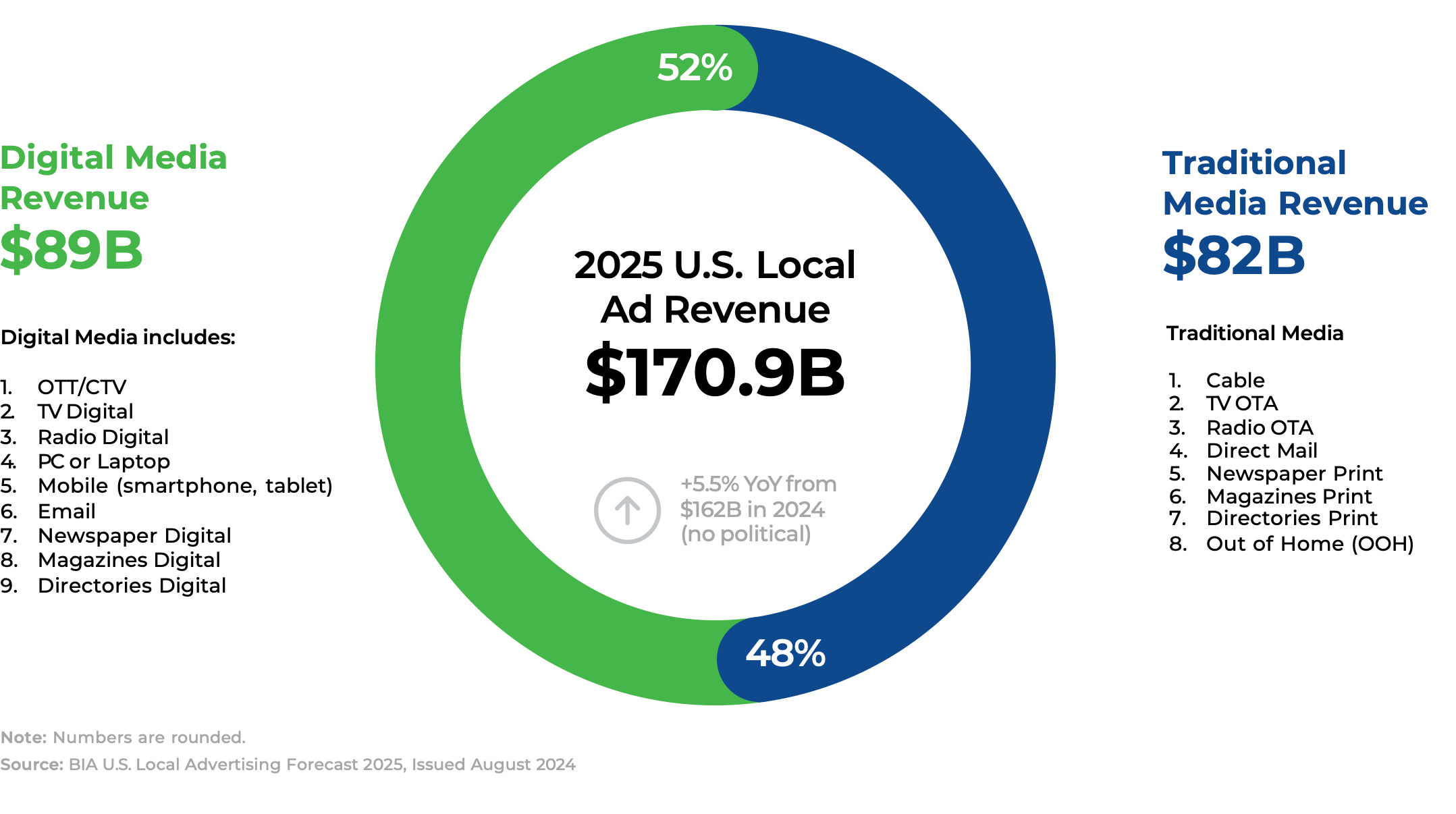

Overall, local advertising spending will increase by 5.5% for a total of $170.9 billion.

In this outlook, we’ll review:

- Local radio airtime revenue projections

- The increases in local digital advertising

- The local CTV/OTT windfall

- Industry spending trends

- Key factors impacting radio revenue

Radio Revenue: Airtime Numbers

Spot ad dollars will have a nominal decline in 2025 by 0.4% for a total of $10 billion. Each market will experience its own plus or minus. Radio still plays an integral part in media planning. It’s the number one mass-reach media, and consumers across all demographics listen to OTA radio.

Stations can see wins in OTA radio advertising. Opportunities include:

Three-minute listener qualifier change could boost ratings and spot rates.

The appeal of local news continues as a trusted source for consumers.

Geo-targeting for FM stations could create more ad spot revenue.

Audio ads have higher retention and recall, creating brand awareness and the ability to convert interest.

Local Digital Ad Spending Surpasses Traditional

For the first time, BIA forecasts that local digital ad spending will surpass traditional.

Local digital ad spending will reach $2.9 billion in 2025 (without political), a growth of 4.2% over 2024. These numbers include all digital tactics except CTV/OTT.

This bump is the true opportunity for radio in 2025. Advertisers have dollars to spend specifically for digital. It’s time to claim those by ensuring they are part of every client discussion. In most cases, they can experiment with you with small campaigns to measure performance and the process. With a mix of tactics, easy ad operations, advanced targeting and premium inventory, you’re ready.

Digital tactics across the board will experience increases, but CTV/OTT leads the way.

Local CTV/OTT Advertising Is Once Again the Fastest-Growing Category

Local CTV/OTT Advertising Is Once Again the Fastest-Growing Category

Streaming advertising has been on a trajectory that outpaces all other digital tactics. It’s become a channel that local advertisers love because of its targetability and the ability to measure its effectiveness.

Where companies advertise always align with consumer preferences. Currently, more U.S. households stream versus having traditional pay TV subscriptions. Most homes have multiple subscriptions, and the surge in new ones favors ad-supported. With plenty of inventory and the ease of producing video ads, local CTV/OTT advertising is in huge demand!

By the numbers:

Local CTV/OTT projected spending

Increase over 2024

89% of U.S. households have a streaming subscription1 and 33% of U.S. viewers only use streaming platforms.3

Streaming services reached a record share of 40.3% of TV usage in the U.S. 2

U.S. consumers are more likely to watch FAST (free ad-supported TV) than pay TV services.4

43% of streaming subscriptions were ad-supported at the end of Q3 2024, marking the fifth straight quarter of growth.5

Industries Increasing CTV/OTT Spending in 2025

(hover)

21.9%

(hover)

17.6%

(hover)

14.7%

How to Win More CTV/OTT Ad Deals in 2025

Pair It with Radio!

A 2024 study found that radio and CTV advertising in a campaign fill the gap for reach created by consumers abandoning linear TV. Streaming ads alone doesn’t get the penetration linear TV once held. Radio and CTV, as an integrated promotion, moves the needle.6

Encourage Advertisers to Shift Budgets

Local businesses are still spending on linear TV ads, and they can have value. However, they don’t reach as many people as they once did. Moving these dollars to CTV can deliver a much better return on investment with measurable results that still play on the big screen.

Paint a Picture of Targeted Advertising

CTV/OTT ads have numerous targeting possibilities. Those include behaviors and interests, and geography, such as ZIP codes, states and designated market areas (DMAs).

Additionally, there are Spanish language options for these ads. By showing ads to the most relevant audience, your customers have a greater potential for creating and converting interest.

Relay That CTV Ads Are Shoppable

All their videos need is a custom QR code that watchers can snap and land on to claim a deal or make a purchase. A study found that 70% of CTV viewers had a positive response to QR-coded ads.7 Since most people have a phone in hand while watching streaming, it’s a convenient way for them to learn more.

Industry Spending Trends: Show Us the Money!

As you make plans for prospecting in 2025, make sure you have these verticals on your list.

Finance and Insurance

Projected radio OTA spend:

$2 billion (-3.3%)

Projected radio digital spend:

$585.7 million (+2.2%)

(hover to learn more)

Spending in this category will contract for radio but grow for digital. Advertising will attempt to support consumers worrying about their financial future. An aging population is also seeing the first Gen Xers heading toward retirement. Younger generations often have high debt and fear for their financial security, which means they are also looking for guidance.

This industry is all about trust, so radio spots can be effective here since listeners see radio as a “trust halo.” Digital will be critical, too, in targeting very specific demographics like homeowners.

Keys to winning ad dollars from finance and insurance companies:

- Emphasize the “trust halo” associated with radio.

- Describe how you can build an audience with digital targeting to reach specific groups.

- Offer creative concepts that include social proof to cultivate more trust.

Restaurants

Projected radio OTA spend:

$635.1 million (+5.8%)

Projected radio digital spend:

$196.6 million (+11.7%)

(hover to learn more)

Restaurants have three categories: QSRs, full-service and special restaurants. Diners will also be fickle in 2025 as they concentrate on value. If this doesn’t align with their discretionary spending, they’ll stay home. Expect local restaurants to wage customer wars, and that’s good news for advertising.

They’ll up their investment in local advertising to lure consumers with lower prices. It’s what they have to compete on in 2025, considering consumers’ complaints about food costs. They’ll also need support in hiring since these are high-churn positions.

Keys to winning ad dollars from restaurants:

- Demonstrate how you help with both of their needs – new customers and workers.

- Guide them on how to use different geofencing strategies to entice diners.

- Come to the table with creativity, like using National Day campaigns on social media.

Grocery Stores

Projected radio OTA spend:

$351.3 million (+0.3%)

Projected radio digital spend:

$108.1 million (+5.9%)

(hover to learn more)

Grocery stores have also been the object of customer ire as prices hit new highs. These businesses have trust to rebuild. Their digital strategy must be omnichannel, with messaging that speaks to lowered prices, special deals through their loyalty programs and pickup and delivery offerings, which remain popular. Radio spots that remind them of these benefits will be critical to a holistic communication campaign.

Keys to winning ad dollars from grocery stores:

- Highlight ways that digital can help them reach specific households (e.g., targeting by language).

- Make OTT/CTV ads a pivotal part of your pitch, as they deliver better ROI than traditional TV spots.

- Bring ideas that help them gain market share from other grocers or dollar stores.

Hospitals and Health Care

Projected radio OTA spend:

$824.4 million (-6.3%)

Projected radio digital spend:

$227 million (-1.1%)

(hover to learn more)

Hospitals and health care face obstacles that advertising can address. They need more employees and patients. Many hospitals have begun to see patients as consumers and have been adapting marketing as such. While spending is decreasing, these challenges still persist and need advertising solutions.

Keys to winning ad dollars from hospitals:

- Propose advertising that helps health care with both its needs – staffing and patient acquisition.

- Focus on campaigns that address common fears or issues for patients, such as accessibility.

- Showcase the people behind the care to develop trust for potential employees and patients.

Retail

Projected radio OTA spend:

$1.5 billion (-0.4%)

Projected radio digital spend:

$466.6 million (+5.1%)

(hover to learn more)

Retail has always been a radio advertiser, looking to reach broad audiences through proven programming. That investment will slightly dip, as the industry looks to capture the attention of price-sensitive consumers who are all out of loyalty sentiment. Targeted digital helps them do this.

Their ad messaging will be all about deals and promotions, and they won’t wait until the fourth quarter to roll out the best ones.

Keys to winning ad dollars from retail:

- Recommend competitive digital ad tactics like geofencing and SEM (search engine marketing).

- Suggest a 12-month campaign that refreshes with new promotions monthly.

- Explain how retailers need diverse channels for advertising that highlight differentiators.

Automotive

Projected radio OTA spend:

$1 billion (-2%)

Projected radio digital spend:

$299.1 million (+3.5%)

(hover to learn more)

The car buying experience has been unique in the past few years. First, inventory was low due to chip shortages. Once manufacturers made this up, interest rates kept drivers in their cars longer. As interest rates decrease, so do promotions and incentives.

In 2025, new car dealers could see a lot more activity for those holding out for a great deal. They can achieve this with targeted and specific digital tactics to personalize offers as much as possible.

Keys to winning ad dollars from automotive:

- Tackle the dealership’s unique circumstances around selling, such as aging inventory or electric vehicles.

- Build campaigns around more than sales; service, rentals and parts are all big money-makers for dealers.

- Call out OTT/CTV as a better channel for engagement and action over traditional TV spots.

Real Estate

Projected radio OTA spend:

$83 million (-3.1%)

Projected radio digital spend:

$24.7 million (+2.4%)

(hover to learn more)

Real estate has always been volatile, but 2025 could see some turnaround if interest rates dip lower. However, don’t expect this to impact mortgage rates immediately. Affordable housing seems out of reach to many. Others want to downsize or expand but haven’t been motivated. This could all reach a head in 2025. Even if buying and selling doesn’t heat up, the rental market will continue to experience high demand.

Keys to winning ad dollars from real estate:

- Propose new ad formats they haven’t previously used to capture digital house hunters, like CTV/OTT and streaming audio.

- Highlight their niche as a buyer’s or seller’s agent or someone who specializes in rentals or relocation.

- Address the challenges of home buying head-on with honest, genuine ad campaigns.

Legal Services

Projected radio digital spend:

$277.6 million (-2.8%)

Projected radio digital spend:

$81.1 million (+2.7%)

(hover to learn more)

Law firms are repeat local media ad buyers. They always need new clients, so they never stop advertising. They’ve historically been traditional media buyers of radio, TV, print, billboards and direct mail. The landscape, however, is experiencing a greater digital transformation. Consumers seeking legal help are more likely to head online. As for their TV presence, many are moving those dollars to CTV/OTT since they can target and measure it.

Keys to winning ad dollars from legal services:

- Advise of changing consumer preferences that require a mix of OTA and digital tactics to achieve their new customer goals.

- Advocate for unique SEM campaigns that answer people’s top questions about legal representation.

- Promote re-engagement through retargeting, as many first-time website visitors aren’t ready to commit.

Factors Influencing Radio Revenue

These projections from BIA are based on lots of data and insights, but they aren’t a crystal ball. Many things can impact radio revenue – most of which you can’t control. However, it’s crucial to understand their influence.

The Economy, Of Course

The U.S. is a consumer-driven economy. As such, advertising slows when spending does. Even though inflation cooled in 2024 and unemployment remained low, many still struggle financially. If the economy continues to grow and wages keep ahead of costs, consumer confidence will be positive.

If the economy sputters, the opposite will be true. The economy, in general, is full of uncertainty. It’s also very local-specific. National numbers don’t accurately depict what’s happening in your city or state.

Competition Is Fiercer Than Ever in Many Industries

Regardless of how confident consumers are, many will remain price-conscious. As noted, retail and restaurants will compete on price and look for every angle to attract customers. They aren’t the only industries. The same applies to grocery stores, auto dealers and home services.

Your local media sales strategy should include a competitive section with plans on how to capitalize on brand wars.

National Spending Trends Could Impact Local

In 2025 and 2026, $9.56 billion will migrate from traditional ad spend to digital. It follows the trajectory line of local digital surpassing local traditional. Experts shared that digital ad spending will likely grow across all industries.8

Another aspect of traditional versus digital is that more than half (54.4%) of B2B advertising remains in the former. It includes print, out-of-home, radio and TV.9

Both these trends deliver opportunities for radio stations to capture these dollars while also holding on to traditional radio investments because you can sell both in an integrated campaign, which has proven to be more effective time and time again.

2025 Radio Revenue: Opportunities and Challenges

The year ahead presents unique opportunities and challenges for radio. How things will play out is still to be determined. Having an agile sales strategy will serve you well, and these data and insights should help!

Go deeper into the data by watching the 2025 Radio Revenue Outlook webinar replay featuring Nicole Ovadia, VP of forecasting at BIA Advisory Services, and Todd Kalman, SVP of sales at Marketron.

Sources: 1 Parks Associates, 2 Nielsen’s The Guage, 3 Statista, 4 Parks Associates, 5 Antenna, 6 Nielsen Media and Westwood One, 7 Xenoss, 8 eMarketer, 9 eMarketer

© 2025 Marketron Broadcast Solutions

Privacy & Legal